This post is also available in:

![]() Melayu (Malay)

Melayu (Malay) ![]() 简体中文 (Chinese (Simplified))

简体中文 (Chinese (Simplified))

Step by Step Guide to Apply for GST Registration in Malaysia

Information Required for GST Registration

· Company / Business’ Details – Company/Business Name, Contact Information

· Financial Account Details – Financial Year End Month, Total Turnover with details breakdown to standard rate supplies, export, zero rated and exempted

· Industry codes (MSIC Code)

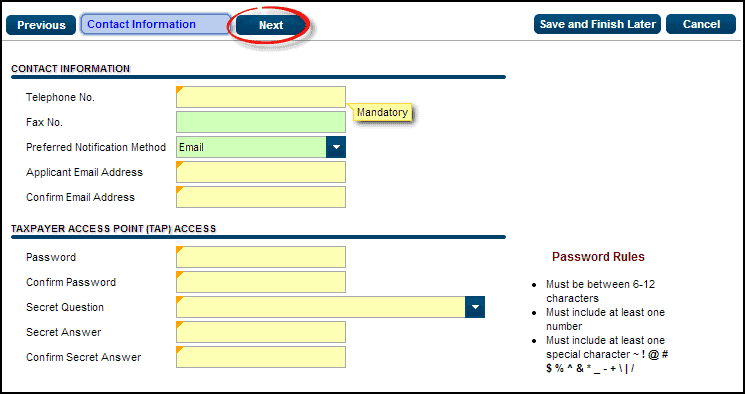

· Bank account information

· Softcopy of Bank Statement (to attach together with the application)

1. Go to GST TAP website, Click Register For GST hyperlink

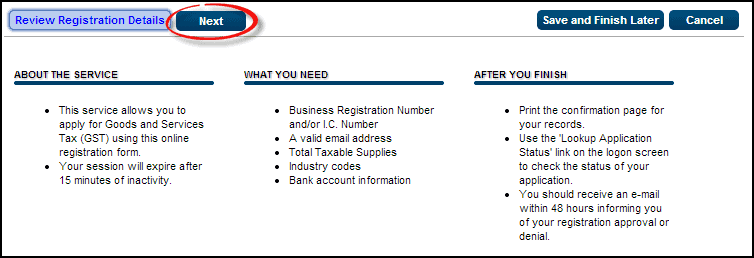

2. The Review Registration Details is the instructions on TAP services, to guide the taxpayer using TAP to register the application.

3. Click Next button: to continue to the next step

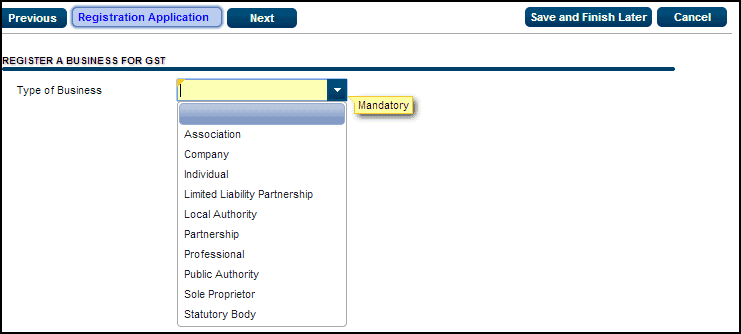

4. Choose Type of Business.

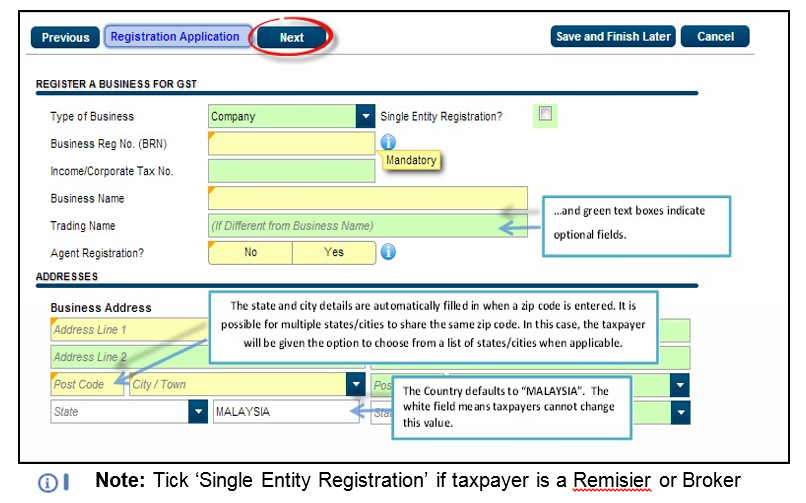

5. Fill in all required information :-

- Yellow text boxes indicate mandatory

- Green text boxes indicate optional

- White text boxes indicate uneditable

6. Once this page is filled in, click Next to continue on next

7. The mandatory fields are specific to the chosen type of

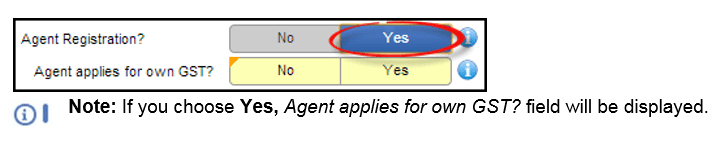

8. Choose either Yes or No in the Agent Registration?

9. The Contact Information will track the applicant’s phone, email, and TAP login

10. Click Next to continue to the next

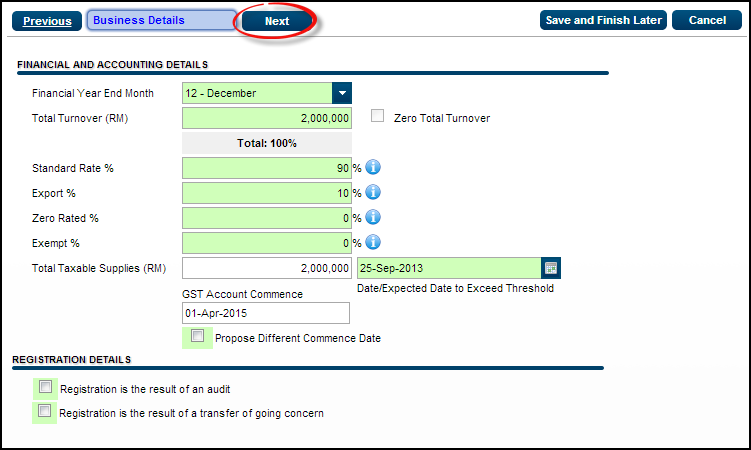

11. Business Detail tab is the screen that requires business financial and accounting

12. Fill in all required information :-

- The total of rate must be 100%.

- Total Taxable Supplies will be auto calculated based on the total turnover and rates entered by the

- The Date/Expected Date to Exceed Threshold will also auto populate when the total taxable amount is greater than RM500,000.

13. Click Next button to continue to the next step.

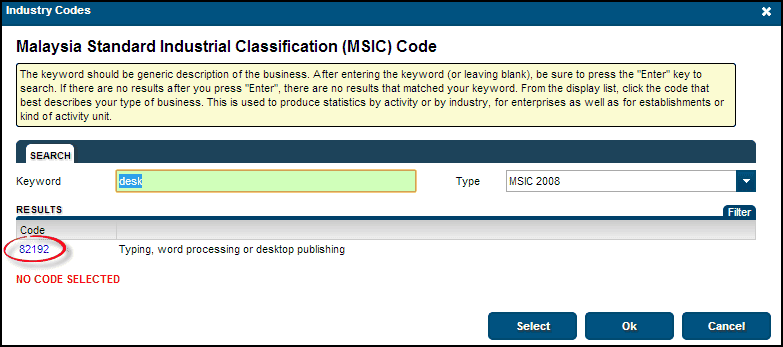

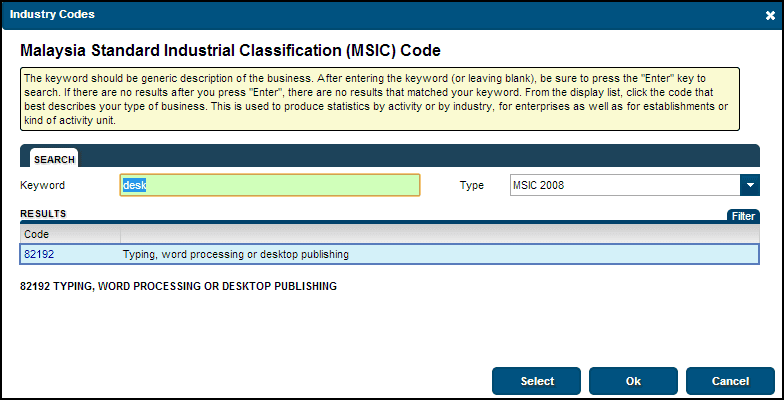

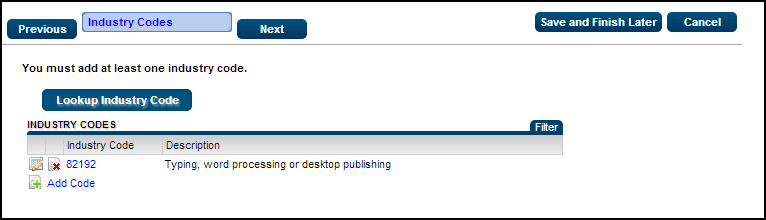

14. The Lookup Industry Code button is used to search the MSIC Click Lookup Industry Code button.

15. Type keyword in the green field and list of related result will

16. Click on Code hyperlink to select and click Select to confirm the code

17. Selected industry code will be Click Add Code hyperlink to add multiple codes in the same time.

18. If the taxpayer already knows the MSIC code, just click the Add Code tab to add the

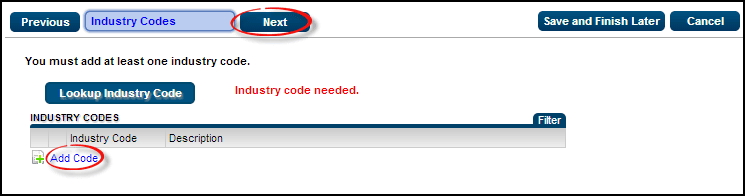

19. At least one industry code need to be

20. Click Next to continue to the next

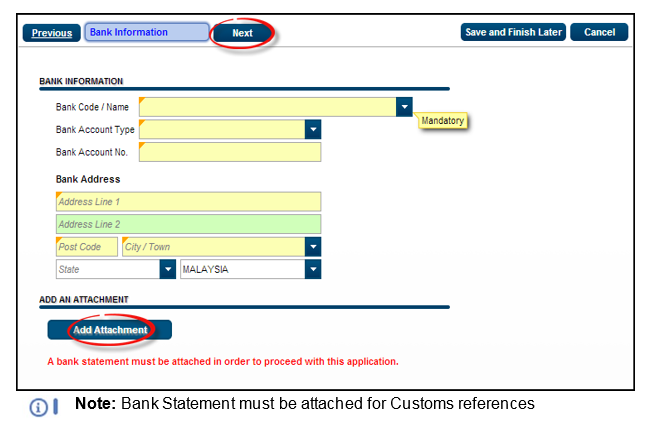

21. The Bank Information tab will require business bank

22. Fill in all required

23. Click Next to continue to the next

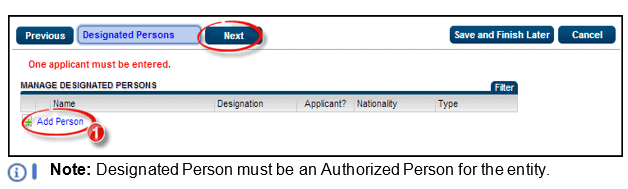

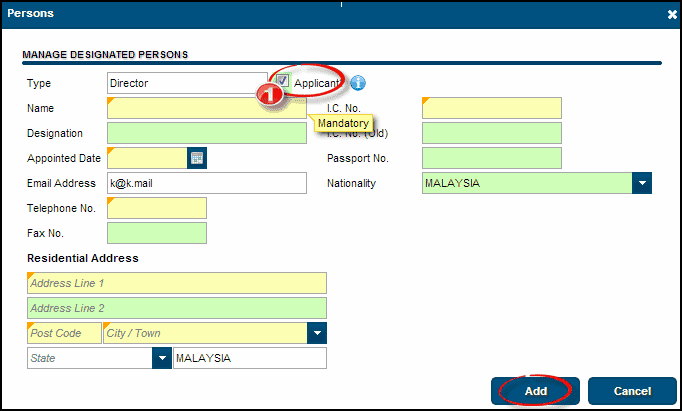

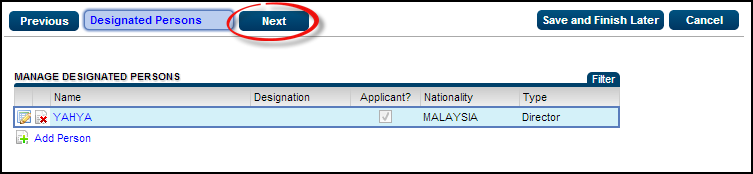

24. The Designated Person tab will require director information.

25. Add at least one person as Designated

26. Click Next button to continue to the next step.

27. Fill in all required

28. The Applicant checkbox should be checked, if the designated person is identified as an applicant for the The applicant will be a contact person for Customs.

29. Click Add

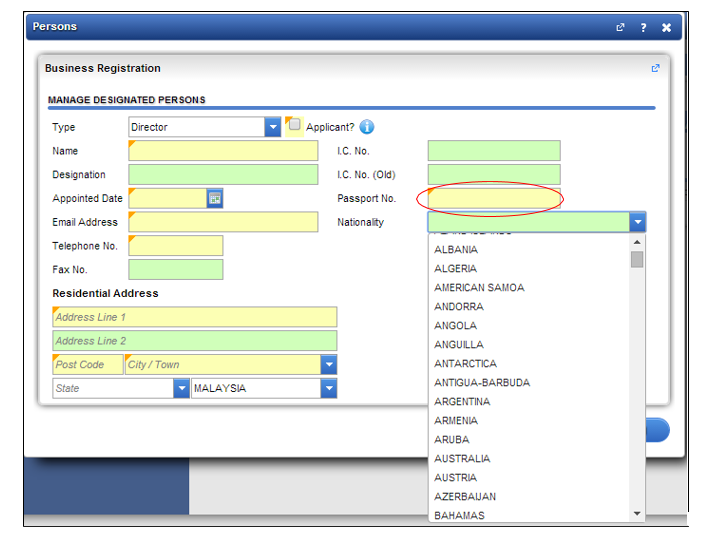

30. Change Nationality by selecting from the drop down list if the director is not Malaysian citizens and the Passport will be the mandatory field.

31. Click Next to continue to the next

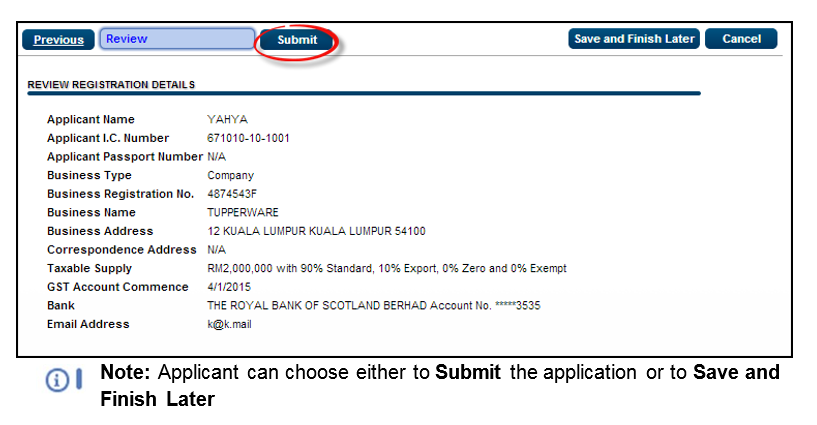

32. This screen will require applicant to review the application details and verify the

33. To submit the application, Click Submit

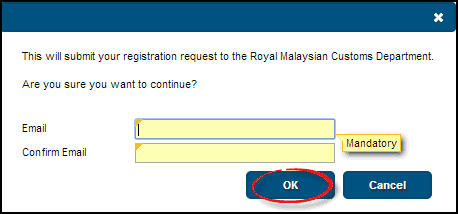

34. Fill in email and confirm email using the same email address in the contact information details (refer to step 10) to submit the registration. Click OK.

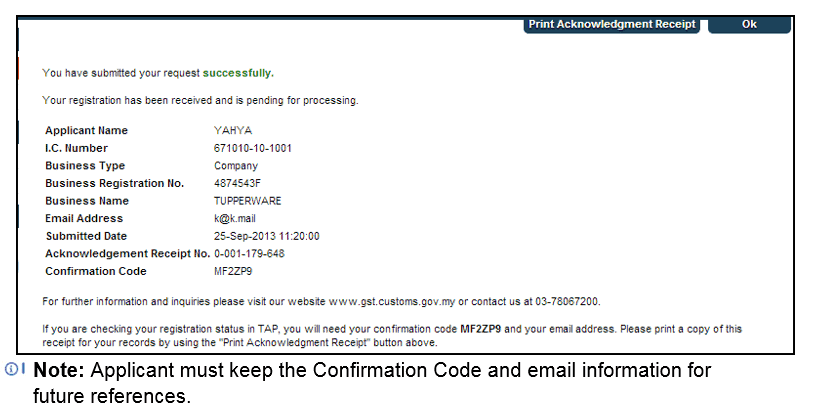

35. This screen will display the confirmation information as

36. Click Print Acknowledgment Receipt button to print the acknowledgement receipt.

37. Click Print Acknowledgement Receipt for your records or click OK to go back to the homepage.